A good payment strategy makes it easy for customers to pay. A hassle-free payment process means customers are likely to buy more and return to your store. Red Stag Fulfillment says 57% of online sales come from mobile shoppers. The report also says that simple checkout pages and clear payment options help increase conversion rates and reduce cart abandonment.

For today’s article, we have listed the five best payment strategies for a Shopify business. From why they are important to how you can implement every strategy, we are guiding you from A to Z. With real-world examples, you will be able to understand everything and become an expert overnight. Without further ado, let us get started.

Many Shopify stores lose buyers right before payment. Long forms, slow pages, or missing payment security warnings make people hesitate. Adding flexible payment methods and keeping the design simple helps. The next section lists the top 5 payment strategies to help you make more profits and gain more loyal customers.

A strong payment strategy starts with a smooth checkout. Many shoppers leave because checkout takes too long or feels confusing. Small changes can fix this. Below are expert tips on how you can make the checkout process faster.

Let People Check Out as Guests

Do not force buyers to create an account. For example, a candle shop that added guest checkout saw 12% more completed purchases. Quick checkout means fewer lost sales and helps reduce cart abandonment.

Use Autofill and Progress Bars

Let browsers fill in names and addresses automatically. For example, add a simple progress bar, like “Step 2 of 3.” It keeps people calm and focused. This creates a seamless checkout experience.

Cut Unnecessary Fields

Ask only for what you need. For example, a clothing store on Shopify reduced its form fields from 12 to 7 and got more completed orders. That is a smart payment strategy in action.

Focus on Mobile Design

More than half of sales come from phones. Keep pages short, buttons large, and scrolling easy. For example, a home decor shop simplified its mobile checkout and saw a 15% increase in orders. Clean design builds trust and keeps shoppers moving.

A thoughtful payment strategy uses smart payment actions to guide customers without pressure. These small details increase comfort and confidence. Let us see what these are.

Show Security Seals Near the Pay Button

Badges like “Shopify Secure” or SSL icons remind buyers that their data is safe. For example, a skincare store added trust symbols and saw its payment security rating improve. That helped increase the conversion rate.

Add Social Proof

People feel safer when others are buying too. For example, a fashion store added a message saying, “52 people bought this today,” and more people completed checkout. Small social cues improve customer trust. Try this trick yourself.

Create Gentle Urgency

Messages like “Only 2 left” or “Offer ends tonight” help people decide faster. For example, a coffee brand ran a 24-hour deal during checkout and sold out faster. These steps keep your payment strategy human and helpful.

Add Reassurance Near Payment

Put return or refund notes close to the pay button. A line like “Free returns within 30 days” makes shoppers feel safe. Buyers notice those small promises right before they pay.

BNPL (Buy Now, Pay Later) turns customers’ hesitation into action. Research from PayPal and Klarna shows that stores using BNPL get 20% more sales and boost average order value by 30%. It is an essential part of any payment strategy. Let us see below the different ways you can use BNLP to your advantage.

Show BNPL Clearly on Product Pages

Do not hide it under “Other methods.” Place it beside the price. When people see flexible payment methods early, they feel more confident. For example, a Shopify jewelry store added this and got more first-time buyers.

Explain BNPL Benefits Simply

Use plain language. Say “Split your payment. No fees, no credit check.” For example, an electronics shop added this note and saw shoppers use BNPL more often. It made their payment options look transparent and fair.

Use Reminders for Abandoned Carts

Follow up with shoppers who leave without buying. For example, a short reminder like “Pay later, interest-free” brought back 8% of lost customers for a shoe store. That is a smart payment strategy that works beyond checkout.

Keep It Aligned with Your Brand

Use calm, friendly language like “Own it now, pay later with confidence.” Shopify merchants can match BNPL colors and tone with their store design. Consistency builds trust.

People want choices. A strong payment strategy gives them options that feel safe and familiar. Find out below the different payment options you can offer to your customers.

Add Digital Wallets

Apple Pay and Google Pay are quick and trusted. For example, a gym gear store added both and saw more mobile sales. These flexible payment methods remove barriers for busy shoppers.

Show Payment Logos Early

Add recognizable logos like Visa, PayPal, and Shop Pay on your product pages. For example, a fragrance brand did this and noticed more people moved to checkout. Familiar logos improve customer trust before payment.

Include Local Payment Methods

If you sell internationally, add regional options like Klarna or iDEAL. For example, a European boutique that did this saw more repeat customers. Local familiarity strengthens your payment strategy and builds long-term trust.

Once a shopper decides to buy, your payment strategy can still increase value per order. Use simple smart payment actions that feel helpful, not salesy.

Offer Free Shipping Thresholds

Show a small note like “Add $12 more for free shipping.” For example, a skincare brand used this and saw a boost in average order value by 18%. It encourages people to add small extras.

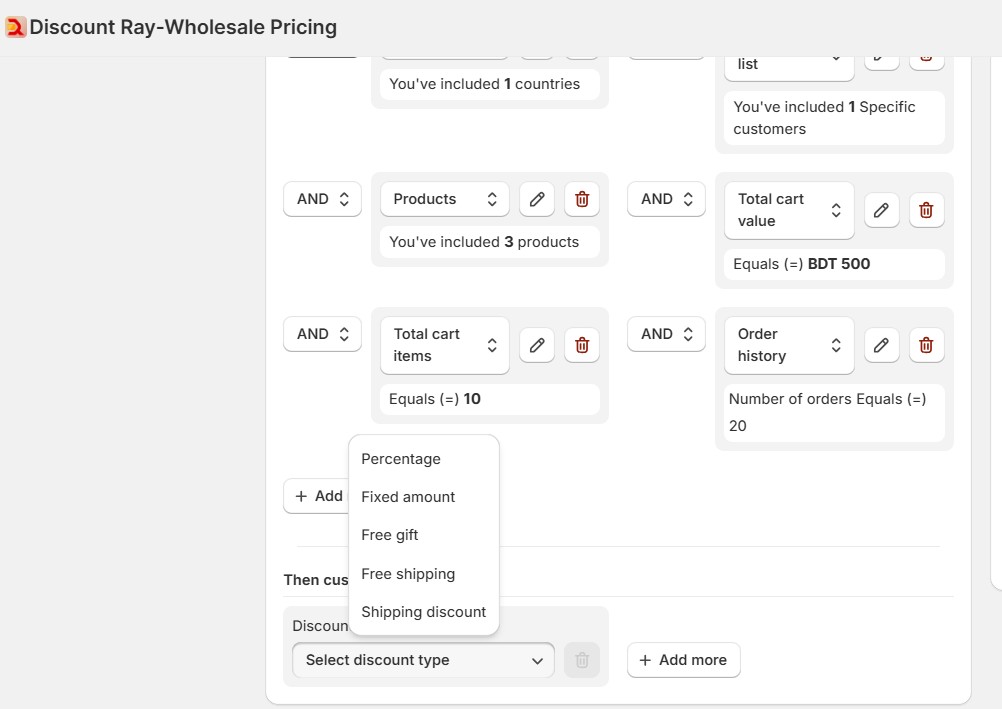

Shopify third-party tools, like personalized discount apps, can help you easily apply offers within a few minutes, including free shipping and free gifts.

These tips on Personalized Discounts and automatic Shopify free shipping discounts can help you further make the most of free shipping.

Suggest Add-ons That Make Sense

If someone buys a camera, show a memory card or case. Relevant items feel useful and can increase conversion rate. These methods work best when they match what buyers already want.

Stay Connected After Purchase

Follow up after checkout with thanks, updates, or small rewards through Shopify. For example, a coffee brand added “Next order: 10% off” to its receipt email and saw more returning customers. A thoughtful payment strategy doesn’t end when the order is complete.

Payment strategy is more than taking payments. It is about creating a checkout that feels simple, safe, and fair. Small changes. Trust badges, flexible payment methods, and clear forms can quickly increase conversion rates and reduce cart abandonment.

When BNPL (Buy Now, Pay Later) removes cost worries, and varied payment options make shoppers comfortable, checkout becomes part of a pleasant experience. Start with one small improvement today. Over time, these fixes help your payment strategy turn more visitors into loyal buyers. Check out our other blogs for more eCommerce tips and tricks.

There’s no one “best method.” Options like Shopify Payments, credit cards, Apple Pay, and local wallets tend to perform strongly.

It depends on your plan and payment gateway. Typical credit card fees run around 2.9% + 30 cents (or similar) in many markets.

Use accelerated checkouts like Shop Pay. Enable auto-fill and reduce extra steps so customers pay faster.

Digital wallets like Apple Pay and Google Pay are used by many. Major credit cards and methods with visible security badges are among the most trusted.

Yes, merchants often get full payment upfront, while the BNPL provider handles installment risk.

Offer credit cards, local e-wallets, and region-specific options like iDEAL, Klarna, or local bank transfers.

It depends on your payout schedule and region. Payments are often deposited within a few business days.

You will usually get an alert. You can ask the customer to retry, offer alternate payment options, or check for input errors.