According to Shopify’s 2025 data, B2B merchants have an average profit margin of around 10%, with top performers reaching 20%. This highlights how strategic pricing and precise profit margin calculations help drive long-lasting growth.

Would you like to achieve the same kind of success for your Shopify store? Then welcome to our blog. Today, we present an article on calculating profit margins after Shopify discounts.

This blog will explain profit margins, how discounts impact them, and how you can calculate and optimize your margins. So, are you ready to know how to get your Shopify business booming? Keep reading!

Profit is the revenue of your business left after covering all expenses. That remaining revenue is the profit and it is a profit margin when expressed as a percentage. Its value indicates the efficiency of your business in turning sales into profits. The profit value can help Shopify merchants predict their business’s financial success.

So, why are we so focused on learning about profit margins? So that you can make clearer decisions about pricing, investments, and discounts. It will help you answer vital questions like:

Gross Profit Margin

It is the money (revenue) left that your business keeps from its sales after covering the cost of goods sold (COGS). It is expressed as a percentage showing products’ profitability before covering other expenses like rent and salaries. Below are the steps on how to calculate gross profit margin in Shopify:

Revenue = $50

COGS = $30

Gross profit = Revenue – COGS

Gross Profit Margin = [(Revenue – COGS) /Revenue]×100 = [(50 – 30)/50]×100 = 40%

This Shopify profit margin formula determines the profitability of individual items at your Shopify store.

Operating Profit Margin

It is the money your business keeps from its sales after covering COGS and operating expenses. Rent, utilities, and salaries are all considered operating expenses. The percentage value you get from calculations determines the efficiency of your everyday operations. Have a look at the following example below to get a better idea of operating profit margin calculation:

Revenue = $60

COGS = $20

Operating Expenses = $10

Operating Income = Revenue – COGS – Operating Expenses = 60 – 20 – 10 = $30

Operating Profit Margin = (Operating Income/Revenue)×100 = [30/60]×100 = 50%

The business has 50% of its revenue left after covering operating expenses.

Net Profit Margin

It provides a comprehensive measure that includes expenses, taxes, and interest. You get a clear picture of your overall profitability through this value. Have a look at the following example below to learn how to calculate the net profit margin:

Revenue = $60

COGS = $20

Operating Expenses (salaries, rent, etc) = $10

Taxes and Interest = $10

Net Profit = 60 – 20 – 10 – 10 = 20

Net Profit Margin = (Net Profit/Revenue)×100 = [(20)/60]×100 = 33.3%

The business has 33.3% of its revenue after covering all expenses.

Shopify merchants catch the attention of their customers with attractive discounts. However, it is important to learn the effective ways of implementing them. Otherwise, you end up facing loss rather than gaining profits.

Excessive discounts or discounts calculated poorly can erode profit margins. You may sell at a loss if you are not calculating profit margin and offer a random 50% discount. Find the right balance between attracting new customers and keeping your business profitable.

You end up hurting your gross profit margin if you do not use discounts the smart way. A discount means a decrease in gross selling price, reducing gross profit margin. Suppose the gross margin of an item is 40% while the product has a 25% discount. In such a situation the profit margin gets reduced by a large number.

This is why we need tools like Shopify profit margin calculators to evaluate the impact before running a promotion.

Effective discounting is all about balance. Strategic planning of discounts to attract new customers while incentivizing existing ones is the way to go. Check out the following approaches below:

Excessive discounts result in discount dependency where customers only buy for offers. To avoid this situation, focus on the following:

We are now going to learn the profit margin calculations for your e-commerce store. Let us find out how you, as a Shopify B2B merchant, can perform these calculations for your business.

Before calculating profit margins, collect the following data:

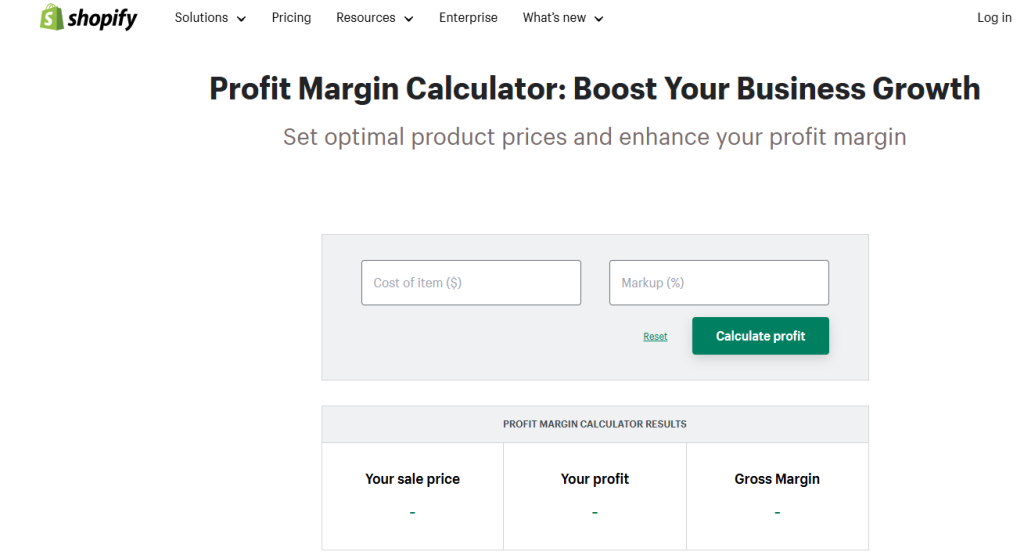

Shopify cares about you which is why it already has built-in analytics for margin calculations. A tool called Shopify profit margin calculator uses automation to provide real-time insights into your margins.

Shopify Profit Margin Calculator

There are also apps available to simplify profit margin calculations. Some third-party discount apps, including some of the best Shopify automatic discount apps, come with advanced discounting features to implement strategies. These features simplify the calculation process so that you can implement discounts quickly.

Let us assume that you have a product with a selling price of $100. It has a COGS value of $60. The below calculations show the before and after discount effect (20%) on the margins.

Before 20% Discount

Gross Profit Margin:

Revenue = $100

COGS = $60

Gross Profit = 100 – 60 = $40

Gross Profit Margin = (Gross Profit/Revenue)×100 = (40/100)×100 = 40%.

After 20% Discount

Gross Profit Margin:

Revenue = $80

COGS = $60

Gross Profit = 80 – 60 = $20

Gross Profit Margin = (Gross Profit/Revenue)×100 = (20/80)×100 = 25%.

This demonstrates why careful calculation is essential before offering discounts.

Reward your customers to buy more through tiered discounting. For example, Buy items over $200 and get 30% off, and if purchase over $400 then get 50% off.

Encourage higher spending by offering complementary items to your buyers.

Product prices are adjusted in real-time according to customer demands, competitor prices, or seasonality.

Lowering costs is another way to safeguard your Shopify profit margins. You can try the following tips:

Discounts are not the only way to bring profits to your store. There are strategies like upselling and cross-selling to help attract buyers and improve sales. Let us explore these options.

Encourage customers to buy a higher-end product. For example, it could be an upgraded version of an item or a product with premium features.

Suggest your customer’s related products that complement their purchase. For example, a person buying a kajal could also be interested in mascara.

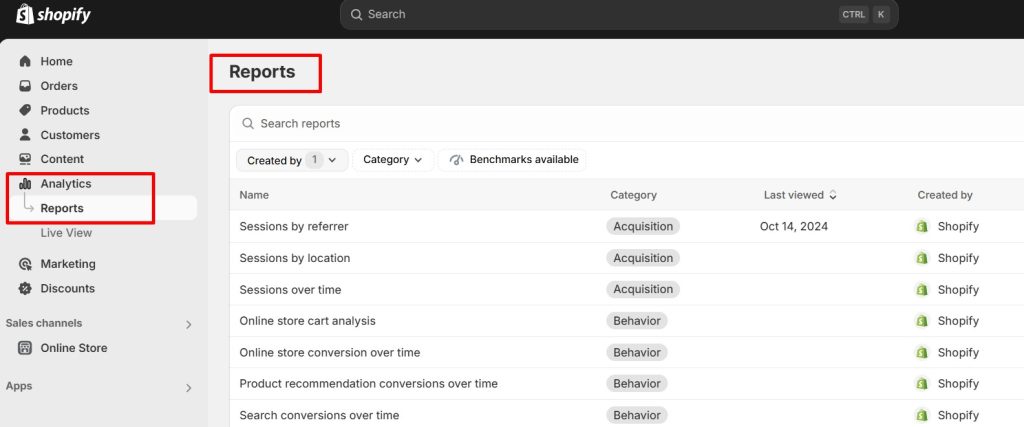

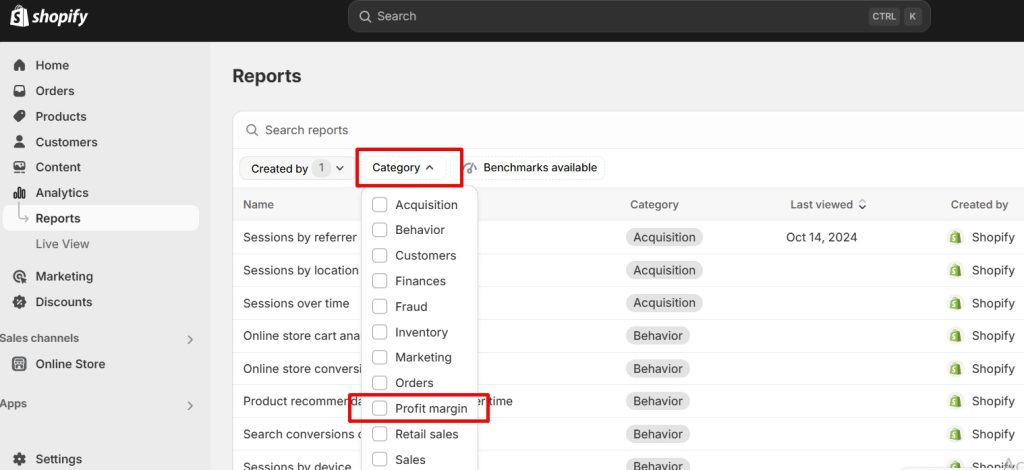

Monitor the financial condition of your e-commerce store using Shopify Analytics. It makes monitoring your business performance easy and simple. Use the analytics to track metrics like:

Shopify Analytics Report

Shopify Analytics Category

Customers have different tastes at different times. Their preferences change as seasons change. You can observe and learn to optimize profit margins after seasonal discounts. Knowing when to offer sales and to whom is the key to becoming a successful Shopify merchant. The following points might help guide you on the right path:

Experimenting with various discount strategies can help identify what works for your Shopify store. Successful e-commerce businesses are always refining strategies through testing. Experiment with:

Try A/B testing as well to figure out which option is the best suited for your Shopify store.

Now you know why calculating profit margins after Shopify discounts is necessary. Have a clear idea about this concept to achieve a profitable business. Learn and understand the relationship between discounts and profitability. Use Shopify’s built-in tools for reports. Apply smart strategies to boost AOV.

Remember that every penny matters which helps you climb up the ladder. The money you earn or save will play a big role in achieving financial growth. So, take the time to calculate, analyze, and figure out how to optimize these margins. We hope this article made your journey easier now. The time to act is now!

In simplest words, profit margin is the revenue left after covering costs. We represent the value as a percentage that determines a business’s profit.

Let us use an example that shows having a 20% margin. Assume that your e-commerce business has made a 20% profit margin. Hence, 20 cents are kept as a profit for every dollar of revenue the business earns.

You achieve this 20 cents profit after covering all expenses. Selling a good for $100 means the business gets to keep $20 as a profit. The remaining $80 covers other costs like salaries, operations, productions, etc.

The profit margin formula is as follows:

Gross Profit Margin = [(Revenue – Cost of Goods Sold (COGS)) ÷ Revenue]×100.

Focus on the following areas to optimize profit margin:

A little price raise on products can boost the revenue of your business.

Reduce operating expenses like labor costs, utilities, maintenance fees, etc.

Increase trustworthiness to generate more sales thereby, increasing net profit margins.

Increase AOV using various discount strategies or recommending products during checkouts.

Build stronger relationships with returning customers by creating loyalty programs

We will explain it using a simple example. Suppose you sell a product for $200 while its COGS is $100. Let us do the calculations of the profit margin below:

Revenue = $200

COGS = $100

Profit = 200 – 100 = $100

Profit Margin = (Profit/Revenue) x 100 = 100/100 x 100 = 100%

While the value seems very desirable, it is rare and often unsustainable. To achieve a 100% profit margin means you have to sell products a lot higher than your competitors. This may deter your customers. However, certain industries and goods can achieve this target. Luxury goods and specialized services might be able to achieve a 100% margin. But having a profit margin between five and fifty percent is also quite good.

Profit is the revenue of your company that is left after COGS has been deducted. Whereas the margin is the percentage of that revenue.

Gross profit margin is the revenue of your business achieved after deducting product costs.

Net profit margin is the revenue of your business achieved after deducting all expenses, including operational costs and taxes.

You have to be smart when using discounts. Smart discount strategies will improve profitability. You can boost sales volume, attract new customers, build stronger bonds with old customers, and increase AOV. But avoid excessive use of discounts.